Learn everything you need to know about PCI Compliance + Bonus tips on preventing a data breach.

Small business, smaller transactions, a lesser threat from cyber attack is what you’d likely believe, isn’t it?

If your answer is yes, we’ve got news for you.

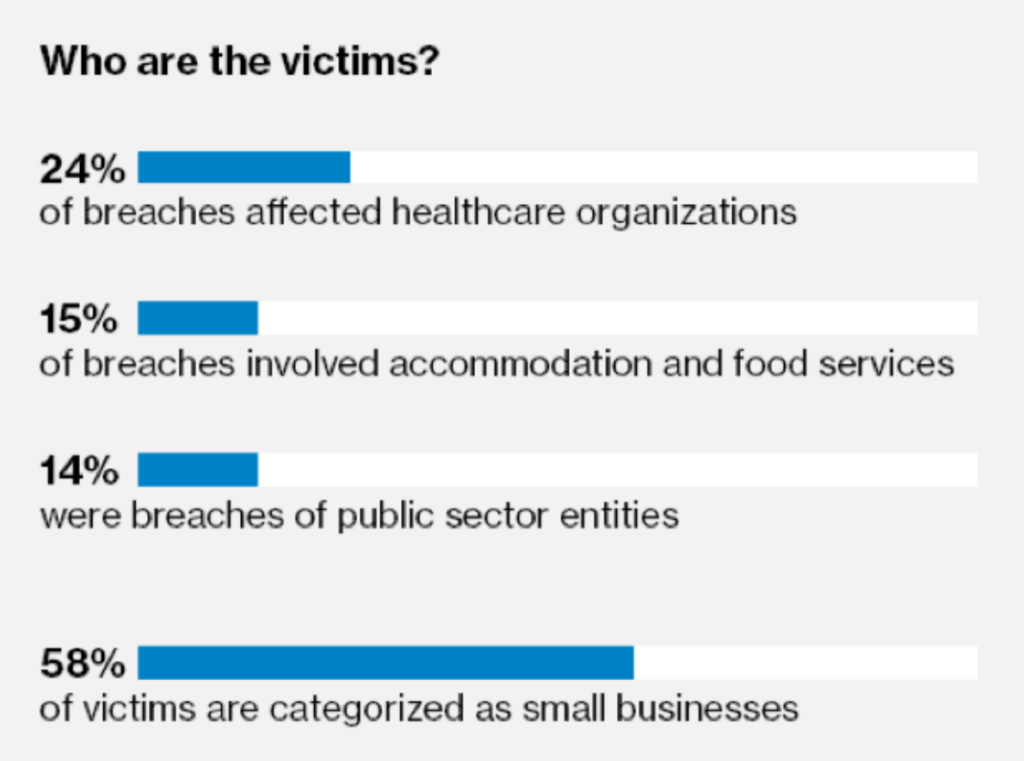

What if we told you that 58% of cyber attack victims are small businesses?

While this may come as a shock, research by Verizon’s 2019 Data Breach Investigation proves it.

Data breaches are a concerning and damaging threat to all kinds of businesses—small and large and are expected to cost the world $6 trillion by 2021.

So how does it concern your service-based small business?

Good question.

If you operate a spa, beauty, barbershop, or wellness business, chances are that you accept credit card payments from your clients. There’s also a chance that their credit card information is saved for future bookings. This provides them—the hackers, an easy playground to breach your system and make merry at your expense.

Not only does a breach in security reflects badly on your brand’s reputation, but it also impacts future revenue.

That’s why providing comprehensive digital security to your clients should stand on top of your priorities for 2021.

Wondering how to go about it?

Enter PCI-DSS security.

In this post, we explain everything you need to know about PCI-DSS security, and what measures you can take to keep your salon/ spa or brand – and your clients – data safe.

Today’s consumers prefer to book as much as they can online – and you need to make it as easy as possible for your clients to book in your services or risk being left behind.

But here’s another thing…

You also need to have a safe and secure online payment gateway to make it work.

While clients often prefer the ease and convenience of booking online, they also want to make sure that they are booking someone who will keep their personal and financial information

Secure.

So what exactly is PCI DSS security/ PCI compliance?

The PCI Compliance Guide defines PCI DSS (Payment Card Industry Data Security Standard) as “a set of requirements designed to ensure that all companies that process, store or transmit credit card information maintain a secure environment.”

PCI compliance means that you have met a set of safety standards that are required for processing financial transactions online. A merchant account that is PCI compliant will have a secure server that allows you to process the payments.

So, how can you make sure that your small business is PCI DSS compliant?

Here are a few things you need to ensure:

A study by GlobalSign found that 84% of users would abandon a purchase if the data were sent over an insecure connection, with many concerned about their data being stolen.

It’s true…

Nothing is more important to online bookers than website security. Their personal and payment details must be kept safe, and if they’re shopping on your service’s website, they need to know they can trust it.

Most websites use “SSL encryption” to protect data that’s transmitted between a website and a shopper. The SSL encryption requires a secure form of communication between a website and the consumer, known as HTTPS – where the ‘s’ stands for secure.

So, if you want to convert potential clients into bookings and maintain a high ranking on Google’s search results page, it’s vital you become HTTPS secure.

When shoppers see the little padlock on their browser, it gives them peace of mind and an immediate sense of trust in your business.

This is indicated to the user in the URL which displays ‘https’ and it also shows the padlock symbol on the left-hand side of the URL bar which reassures people their data is secure when entering private details.

In a nutshell, HTTPS provides confidentiality, integrity, and authentication.

As of July 2018, Google favors websites that are HTTPS secure. If your site isn’t secure, Google may warn users it isn’t safe and could even restrict access to your web pages.

So, how do you become HTTPS secure?

You begin by obtaining a security certificate for your site from a certificate authority. A certificate authority takes steps to verify your website as your own and prevents it from man-in-the-middle attacks.

There are a couple of things to remember here—pick the right kind of certificate for your business, ensuring that it’s reliable, and see that it offers technical support to help you through it.

Payment gateways are third-party services that process card payments on behalf of your business. They will usually take a small percentage of each transaction made for the use of their service.

An online payment gateway is a system that works with your book now button in order to allow you to process secure payments online. It will authorize credit card information of customers who want to make their bookings instantly on your website.

Make sure your appointment scheduling and business management software supports the secure transmission of payment card details and sends clients an automatic confirmation message as soon as payment is accepted.

This will show clients you are trustworthy and provide reassurance that their information has gone to the right place.

As a small service provider, there are several features you need in an online payment gateway:

The experience of processing an online payment should be effortless for your clients. They should not even be aware that an online payment gateway is being used.

It’s essential that you work with a gateway that connects with your book now button and works with it properly.

You want your customers to be able to book your services without having any issues during the online payment process.

This is of the utmost importance when it comes to choosing an online payment gateway.

A study by Trustwave’s SpiderLabs showed that of 218 data breach investigations from 24 countries, of the data stolen, 98% was credit card information.

Your clients are entrusting you with their most personal and private financial information, and you must protect them at all costs.

It’s not enough to have an SSL certificate on your website or rely solely on third-party payment services such as Stripe to handle your clients’ credit card security. Each program you use must be securely locked down.

Discuss data storage techniques with your online payment gateway in order to be sure that your valued customers’ information will be safe and secure at all times.

It’s essential to have a positive working relationship with the support team at the online payment gateway that you choose.

They should be available to assist you in the event of an unforeseen circumstance or if any issues arise.

If your payment provider offers currency conversion, expect to have more international clients come your way.

Choose an online payment gateway that will convert any currency without charging you excessive fees to do so.

Booksy has partnered with Stripe— a trusted leader in the online payment space and fully integrates with Booksy appointments and calendar.

Now that you’ve got the hang of what PCI-DSS Security all about, let’s move forward and look at simple tips that you can use to prevent a data breach.

An excellent method for this is to use internet-based (cloud) technology instead of updating software programs on multiple computers. With cloud technology, you will only require one application login, and your data will be consistently backed up.

Because cloud-based suppliers automatically backup and update their system, the need for costly hardware and the worry of losing valuable customer information during difficult installations will be eliminated.

Creating different users and splitting access levels for each employee will reduce the opportunity for a hacker to gain control of your system. Managing what access employees have also makes it easier to track user activity and restrict access to certain areas.

For example, your appointment scheduling or business management solution should allow you to select between ‘User’ or ‘Supervisor’ and implement two-factor authentication for sensitive information. This adds a high level of security for your front desk system, and the client information it stores, by limiting access to only your necessary employees.

With so many staff members with access, training them is crucial in preventing a data breach.

You need to train them to identify the types of malware attacks. In some cases, spam messages can carry dangerous malware and be very convincing. You also need to set up a

process of escalation in case something goes wrong and you need to act fast.

The most common security threats are malware and spam.

Malware, short for malicious software, is the most common and most dangerous online security threat thanks to its diversity. It poses many dangers to appointment scheduling technology, such as reservations systems. Types of malware that you may be familiar with include viruses and ransomware.

Spam refers to an unsolicited message – usually advertising material (think of the ‘spam’ folder in your email). Your staff should avoid opening emails and clicking links that look suspicious or are asking you to provide money or personal details.

Does your ex-staff still have access to your systems? Did you delete their profiles once they left?

Often we get entangled in our everyday business so much that we forget to maintain the hygiene of our data and take steps to ensure that everything is in order.

However time-consuming it sounds, it’s still important.

Deleting all access to ex-employees, and updating passwords with each employee exit are a few ways in which you can lower data breach.

Times have changed, and you’re business now allows booking your spa, salon, or wellness service online.

While this is great for you and your clients, it does expose your small business to a data breach. In fact, the smaller your business, the more vulnerable you are to attack.

Getting your small business PCI compliant is the first step that you can take to prevent it from malicious attack and setting yourself for success.

If you haven’t already, make this a priority in 2021!

Looking for online scheduling software that offers top-notch security? Book a free trial with Booksy.