The world’s a bit crazy at the moment with COVID-19. And crazy might be an understatement. For consumers and business owners alike, life as we know it is incredibly different than it was just 4 weeks ago.

Now with the rapid spread of COVID-19, State and federal governments are temporarily shutting everything including hair salons, spas, barbershops, and even wellness centers.

While larger businesses have cash reserves to weather the storm, service-based entrepreneurs—like you— don’t have it quite so easy.

Fortunately, there are fast funding options available to help your service-based business stay afloat impacted by COVID-19. Whether you need quick cash to pay the bills, cover payroll, or invest in clever business adaptations (here are a few of our favorites), there’s a loan for you.

In this article, we’re going to break down all your options and help you find financing as quickly as possible.

While no one wants an economic emergency, we have to count our blessings. Thanks to online lenders, there’s never been an easier time to get quick, affordable small business loans.

Long gone are the days of week-long application and approval processes with traditional banks. Now, there’s a much faster way.

Online lenders are taking the speed bumps out of the lending process. You can apply online in minutes and get access to capital in as little as 24 hours. No, that’s not hyperbole—that’s the reality of alternative lending.

With advanced underwriting programs that combine human expertise with topnotch tech, alternative online lenders expedite the process and return decisions in no time. That means quicker applications for you and less time sitting around waiting on answers. Win-win.

Plus, online lenders provide alternative lending options. You’re not just limited to your typical term loans (although those are available, too)—you have merchant cash advances, lines of credit, and more.

But which loans will best serve your business in this time of need? Let’s take a look at your 7 fastest funding options, as well as a few other financing methods to give your cash flow a boost.

A business line of credit lets you access a certain amount of cash (like a credit card), and you only pay interest on the funds you use. Once you borrow, use, and repay, the funds become available to borrow again—no need to reapply and go through the whole process anew.

Oh, and you can use your line of credit on just about anything. Need to pay an invoice? No problem. Want to pay your employees’ wages? Got you covered. And if you never use it—no worries. It’s a no-obligation safety net. It certainly won’t hurt to keep a line of credit in your back pocket.

Applying is quick and easy, and you can expect to receive a decision in as little as seven days. It’s not the fastest financing (still quick, though), but once you’ve secured it, it’ll be as rapid as your credit card.

A business term loan is your classic funding option. You get a lump sum of cash and make monthly payments to pay for the loan. It’s simple, predictable, and oh-so powerful.

Term loans aren’t typically as fast as short-term loans (more on those in a minute), but the times are changing. Now with online lenders, you can get approved in as little as 24 hours (although it can take up to a few days).

So unless you need funding in a matter of minutes, you may find it worthwhile to sacrifice a little bit of speed for more capital, lower interest rates, and longer repayment terms.

Use your term loan to finance just about any business need you can think of — it’s one of the most flexible funding options around.

Imagine your traditional business term loan, just a lot faster. There’s limited paperwork, and your application is entirely online. With a short-term loan, you could have ready-to-use money in your account in a matter of hours.

Like a term loan, it’s flexible. Use it to cover unexpected costs, finance a quick project, or survive an emergency.

However, speed comes at a price. Because of minimal vetting and a less rigid application, lenders consider short-term business loans a risky endeavor. As a result, short-term loans are some of the most expensive small business loans.

Your existing business credit card is perhaps your quickest source of funds during COVID-19

If you don’t have a business credit card already, it’s easy to apply. But, it usually takes at least a week before you get approved and can start using it.

At a time like this, look for a card with a 0% Introductory APR. It will get you interest-free financing and balance transfers for a short period of time. After the introductory period is over, you’ll get a new rate. But hopefully, that’s when the worst of COVID-19 crisis will be behind us. Use your business credit card anytime, anywhere, on any business need. It’s fast, flexible, and handy for crazy times like this.

Just make sure you have enough money to pay off your balance in full at the end of the pay period. Otherwise, you could end up racking up serious debt in interest fees.

A merchant cash advance is a type of short-term loan, essentially offering money now in exchange for a percentage of your sales (plus interest) later. If your business is usually booming, but things have slowed down due to COVID-19 restrictions or closures, a cash advance can give you the capital you need to weather the storm.

A merchant cash advance is easy to qualify for and a super-fast form of financing — you can usually get the cash you need within just a few hours. Since you pay off your loan based on daily credit card sales, you’ll make smaller payments during slower weeks or months (like now).

But borrowers beware: this super-fast form of financing also typically comes with a super-high annual percentage rate (as much as 250%) due to the speed of repayment.

SBA loans are typically one of the most sought-after small business loans. With large loan amounts, low-interest rates, and flexible repayment terms, it’s not hard to imagine why.

To support small businesses impacted by the coronavirus, the SBA is offering low-interest loans up to $2 million. Small businesses can get these Economic Injury Disaster Loans (EIDLs) with an interest rate of 3.75%.

While this isn’t the fastest loan on the market, the SBA is striving to expedite their processes and review and approve all loans in 2-3 weeks. To account for the time-sensitivity of getting cash into the hands of small business owners, borrowers can apply for an Economic Injury Disaster Loan advance of up to $10,000.

Use this SBA loan to use to cover payments, debts, payroll, and any other bills affected by the coronavirus. Apply online here. Note: the site is receiving high volumes of traffic and may be slow to load. The SBA also says the Chrome browser is struggling, so try another browser like Safari or Internet Explorer.

If you have time to spare, this is a loan worth waiting for.

Already have a relationship with an SBA Express Lender? Good news — under the Express Bridge Loan Pilot Program, you may be able to get up to $25,000 with less paperwork. These loans are designed to help bolster cash flow due to loss of revenue and can serve as a bridge loan while you wait for decision and disbursement on an EIDL.

Under the CARES Act, $349 billion has been allocated towards the newly created Paycheck Protection Program. Small businesses can access 100% federally guaranteed loans equal to 8 weeks of prior average payroll plus an additional 25% of that amount (but no more than $10 million). The maximum interest rate is 1% and there are no fees. And if you maintain your workforce, the portion of the loan used to cover payroll and other debt obligations (including mortgage payments, rent, and utilities) will be forgiven. Loan payments will be deferred for at least the first six months to provide some breathing room for businesses to get back on their feet.

You can sign up on the updates for Paycheck Protection Program here.

Check out “Way Out Of A Financial Crisis: 8+ Small Business Relief Programs You Should Know About [An Evolving List]” for additional resources.

Due to the COVID-19 pandemic, online lenders, nonprofits, and local governments are providing financial assistance by way of microloans – loans under $50,000.

If you launch a capital raise on Mainvest, you may be eligible for a $2,000 zero-interest loan immediately.

Kiva is a nonprofit organization that has been providing zero-interest loans for the last 10 years. In response to the COVID-19 pandemic, they’ve increased their maximum loan amount from $10,000 to $15,000, and the organization is offering new borrowers a grace period of up to 6 months. Here are some tips to help you get approved and funded quickly.

Depending on the city you call home, there may be microloans (in addition to larger loans) available from your local government. We’ve included a few examples below, but make sure to check your city’s website to see what’s available.

Los Angeles City Small Business Emergency Microloan Program

The City of Los Angeles is offering zero-interest and low-interest microloans to small businesses affected by COVID-19. You can borrow between $5,000 and $20,000 with 0-3% interest rates to cover working capital expenses. You can apply here.

Chicago Small Business Resiliency Fund

The City of Chicago established a Chicago Small Business Resiliency Fund, which offers low-interest loans of up to $50,000 to struggling small business owners. You must use the loan proceeds for working capital, with 50% of the funds applied towards “payroll and commitment to retain the workforce at 50% of pre-COVID-19 levels”.

Salt Lake City’s Emergency Loan Program

The Salt Lake City Government is offering zero-interest loans of up to $20,000 with repayment terms of up to five years. You can use these funds for working capital, inventory, and marketing. The second round application period will be open until Thursday, April 2nd, at 11:59 p.m (so get your application in fast!).

Protip: Due to the high volume of applications, many cities are implementing “application round periods.” Keep tabs on these deadlines; otherwise, you may have to wait to submit your application.

Grants are the best kind of financing you can find. You don’t pay back a grant—it’s essentially free money.

Right now, states and cities around the country are offering geographic-specific coronavirus funding to small businesses. Here are a few to consider:

Denver’s program provides cash grants of up to $7,500 to businesses hard-hit by the coronavirus—mainly restaurants, barbershops, nail salons, and retail shops.

Michigan is providing both grants and loans to small businesses impacted by the coronavirus. You can get a grant of up to $10,000 to help with working capital, and loan amounts are available from $50,000 to $200,000 at interest rates of 0.25% will also be available.

Small businesses with four employees or less can apply for grants up to $27,000 to help cover 40% of payroll costs for two months. To qualify, you’ll need to prove that you’ve lost at least 25% of your revenue because of the coronavirus.

The options listed above are by no means a complete list. More and more grants are being added every day, so check your governor’s website for up-to-date additions.

Wellness Relief Fund

Reclamation Ventures is offering grants “to cover one month of missed revenue (up to $2,500) for wellness spaces and wellness instructors that represent underestimated communities”. Funds can be spent on organizational needs (programmatic, operational) or as a personal stipend to cover salary, living expenses, or debt obligations. You have until April 30 to apply.

The PBA COVID-19 Relief Fund

Through a new fund created by the Professional Beauty Association and PBA, licensed beauty professionals can apply for $500 in funding to cover short-term immediate needs such as food and bills. You can apply here.

Now’s a time of giving, and you won’t find more no-strings-attached giving than on GoFundMe. As part of the GoFundMe Coronavirus Small Business Relief Initiative, small business owners can start a fundraiser to receive financial aid from the community. You can also apply for a matching grant of $500 through the Small Business Relief Fund.

People want to support their local small businesses, so create a fundraiser and get the word out — post it on your social media accounts and email your clients directly. Don’t be bashful—the whole country (and the world, for that matter) are feeling the effects of the coronavirus.

Citizens want to see the businesses we know and love survive—and you can see from the contributions on this GoFundMe page that there’s an abundance of charity occurring online.

Another way to crowd-fund at this time is through gift certificates. It’s a win-win opportunity for both parties for both the business in distress as well as their customer.

It allows customers of small businesses to buy gift cards from their favorite business to be used later, pumping up their finances, whereas for business owners it serves as an opportunity to free up cash flow.

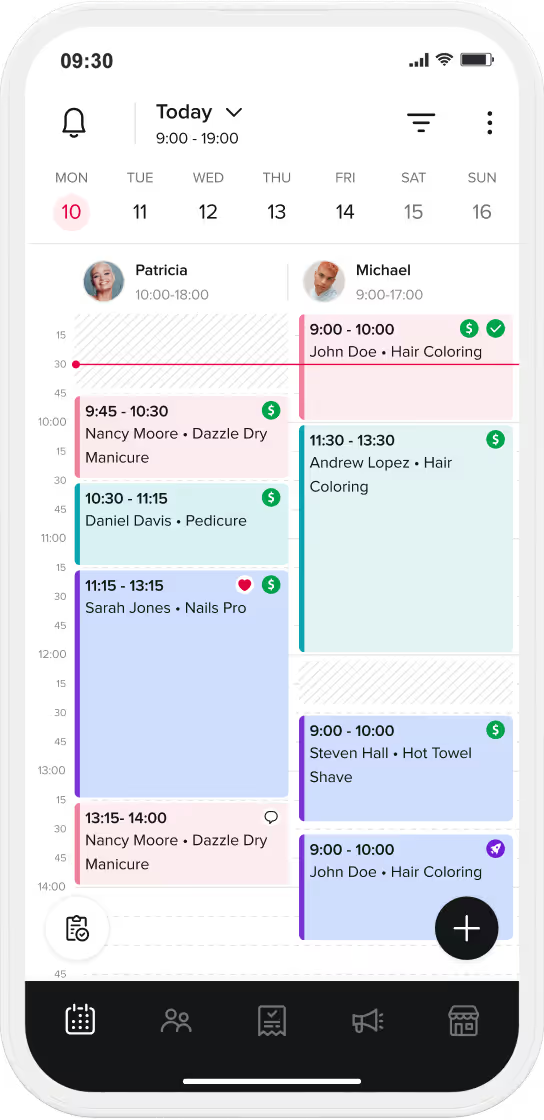

Booksy's online scheduling software is helping small businesses entrepreneurs in the hair, beauty and wellness space to set up gift certificates to be used later (or as a donation)

While the government and lenders are far more lenient with their lending at the moment, you’ll still need to do your part to make sure you get funded fast. Here are four simple tips to accelerate your financing.

Just knowing you need cash isn’t enough. Look through your present-day and historical financial records to see how coronavirus may have impacted your cash flow.

Do you just need money to pay the bills? Will you need to invest in expanding the business? Crunch the numbers and run through a few different scenarios. Doing this will help you zero in on more concrete numbers.

Don’t wait until you decide to apply to get your paperwork together. Take a look through your bookkeeping records and make sure everything is up-to-date. Have your balance sheets, cash flow statements, and income statements ready to go. You don’t want to be collecting these records in a panic later.

Even if you don’t need cash at this very moment, go ahead and secure some financing as a safety net. It’s the perfect time to go ahead and put a business line of credit or credit card in your back pocket—just in case.

Apply for all the grants that you qualify for. Grants are essentially free money, so all that they cost is the time you spend on the application.

Banks, cities, and states are providing new relief programs every day. Keep these on your radar so you can apply quickly when relevant funding becomes available. The sooner you apply, the sooner you can get approved and funded.

While this worldwide pandemic has everyone scared, now’s not the time to panic. Take your time, weigh your options, and get the funding your small business needs. You also want to make sure you’re cutting costs (where feasible) and experimenting with new ways to generate revenue, while continuing to communicate with your customers.

Governments, communities, banks, and online lenders are uniting to help relieve small businesses. You’re not alone. With a little financial assistance, you can get the capital you need to keep your business afloat. Don’t wait until it’s too late—do your research now, make your plans A, B, and C, and position your business for survival.

Reopen with confidence and evaluate your business health, revenue and safety. Get a personalized plan that will help make more money, book more clients and prepare you, your staff and your clients for re-opening without compromising their safety.

This is a guest post by Samantha Novick who’s a senior editor at Funding Circle, specializing in small business financing. She has a bachelor’s degree from the Gallatin School of Individualized Study at New York University. Prior to Funding Circle, Samantha was a community manager at Marcus by Goldman Sachs. Her work has been featured in a number of top small business resource sites and publications.