Creating a financial plan might seem overwhelming, especially if economics wasn’t part of your beauty school curriculum. But don’t panic—building a simple yet effective financial strategy is easier than you think and is the key to running a profitable salon.

A solid financial plan will help you allocate funds effectively, prioritize expenses, and set your salon up for long-term success. From handling operating costs to investing in growth opportunities, this guide will walk you through creating a financial plan for your hair salon. Let’s get started!

A financial plan isn’t just about crunching numbers—it’s about creating a roadmap for your salon’s financial health. It ensures that your income is distributed effectively, covering essentials like:

Without a financial plan, it’s easy to overspend in some areas while neglecting others. To start, prioritize your salon’s non-negotiable expenses, such as rent, utilities, and staff wages. Once these are covered, allocate your remaining budget toward growth-focused areas like marketing, remodeling, or new equipment.

Pro Tip: Use a digital spreadsheet or salon management software to track your earnings and expenses. This allows you to see where your money is going at a glance and adjust your spending when needed.

Before diving into the numbers, ask yourself: What are your salon’s financial priorities? Having clear goals will guide your spending decisions and ensure you stay focused on what matters most.

Once you’ve identified your goals, prioritize them by importance and cost. For example, if your salon’s chairs or tools are outdated, upgrading equipment might take precedence over launching a new marketing campaign.

Pro Tip: Assign a budget to each goal and break it into manageable steps. For instance, instead of remodeling your entire salon at once, focus on one area at a time.

Timing is everything when it comes to financial planning. Even the best ideas can fail if executed at the wrong time. Whether it’s launching a marketing campaign, remodeling your salon, or handing out customer gifts, aligning your goals with your salon’s business cycles is critical.

Example: Instead of offering random discounts throughout the year, create a targeted promotion like, “Spend $150 during [insert slow month] and receive a complimentary home care kit!”

Pro Tip: Always have a backup budget for unexpected expenses, especially for projects like remodeling or equipment upgrades, as they can quickly go over budget.

To build an accurate financial plan, you need solid data—not sticky notes and receipts! Reports provide the insight you need to identify trends, manage cash flow, and make data-driven decisions for your salon.

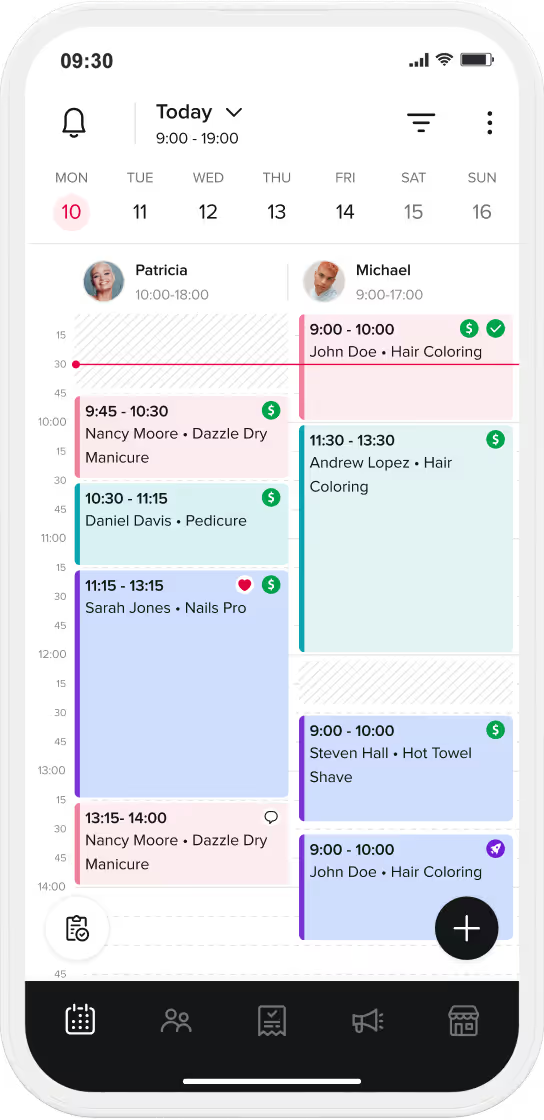

Hair salon management software like Booksy makes it easy to generate detailed reports with just a few clicks. These tools can track daily, weekly, monthly, or annual performance and provide insights on:

By analyzing these reports, you can make informed decisions about where to allocate your budget, whether it’s boosting marketing, hiring new staff, or expanding your service menu.

Pro Tip: Schedule regular financial reviews (monthly or quarterly) to stay on top of your salon’s performance and adjust your financial plan as needed.

A financial plan is only as good as the budget that supports it. Divide your expenses into two main categories:

Tips for Managing Expenses:

Growth doesn’t happen without investment. Once your essential expenses are covered, allocate part of your budget to opportunities that can help your salon expand.

If your salon needs a financial boost, consider small business loans, grants, or partnerships. Presenting a well-organized financial plan to lenders or investors shows them you’re serious about your business.

Creating a financial plan for your hair salon might seem daunting at first, but it’s a powerful tool for running a profitable, stress-free business. By setting clear goals, managing expenses, and timing your investments wisely, you can keep your salon financially healthy and ready for growth.

Start by using salon management software to track your finances, generate reports, and build a plan that works for you. Whether you’re planning your next big marketing campaign, upgrading your space, or rewarding loyal customers, a strong financial strategy will help you make the most of your hard-earned revenue.